In what industry insiders are calling “the most vertical integration since God invented clouds,” billionaire Mark Cuban has launched 27 entirely new podcasts for the express purpose of being a guest on them.

“I was running out of shows to be on. I had to do something,” Cuban admitted, leaning back in a chair surrounded by branded microphone arms. “It’s just a shame I can’t be giving my opinion to every single human 24/7. But, we’re working to solve that.”

Investors are practically levitating with excitement. “He’s eliminating the middleman and the small talk,” said hedge fund magnate Crispin Dollarsnort IV. “Why waste time on another host’s schedule when you can control the entire media cycle and branding arc from the comfort of your yacht?”

Early market analysis predicts the Cuban Podcast Universe (CPU) will not only corner the audio market but redefine the concept of guest appearances altogether. “It’s like Tesla, but for talking,” noted angel investor Penelope ‘Cash Magnet’ Boomington. “Sure, no one has actually listened to any of them yet, but that’s a minor detail. We mainly measure our success via podcast uploads… and we got a shit ton of those.”

TL;DR — Cuban is now his own interviewer, guest, audience, and hype man as God intended.

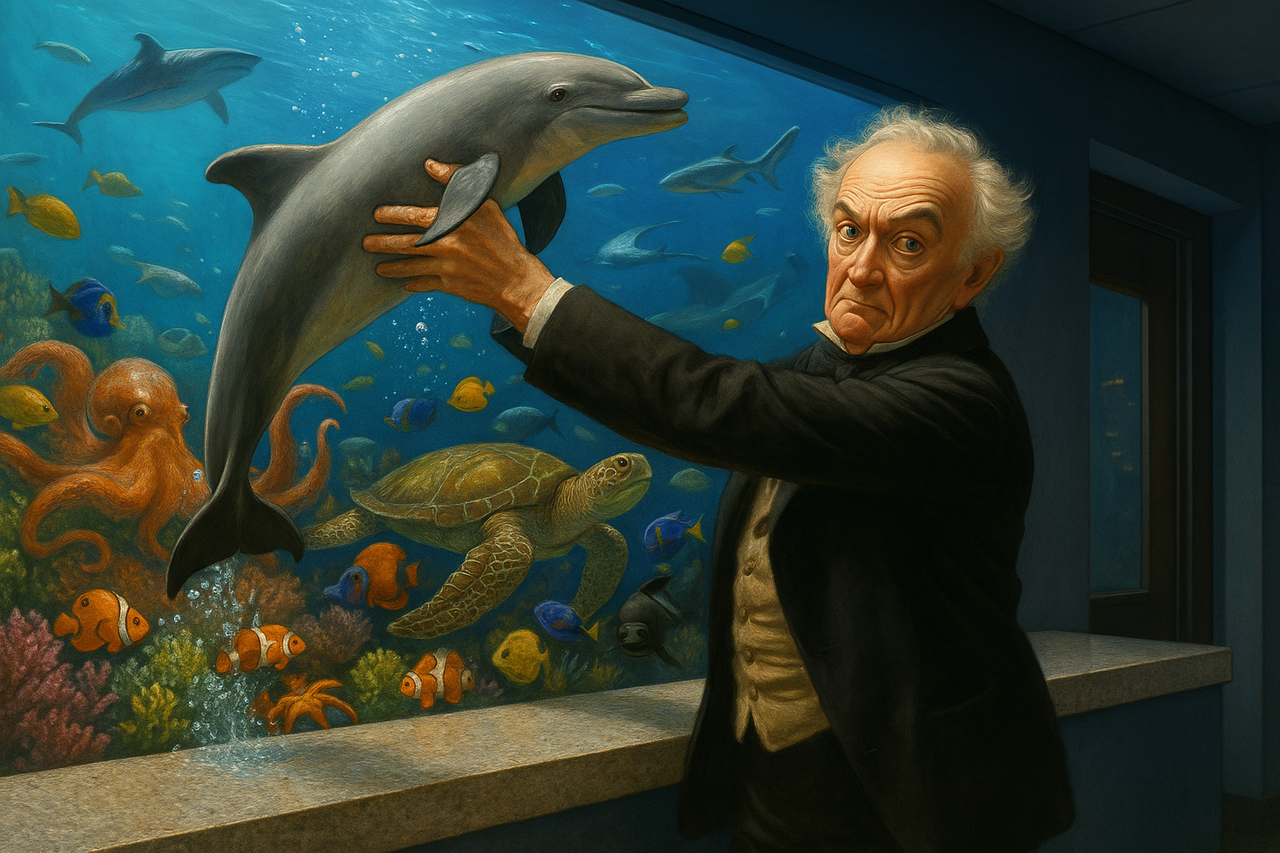

In a move marine biologists are calling “ethically catastrophic” and investors are calling “a blue-chip opportunity,” disruptive ocean venture Ocean Zone has announced plans to capture, monetize, and brand more aquatic life than SeaWorld “could dream of.”

“Our goal is simple,” said founder Triton Cashwave III while sipping champagne from a conch shell. “If it swims, drifts, or even just looks moist, we’ll slap a QR code on it and rent it by the hour. It's time these sea creatures start earning their due.”

Hedge fund heavyweight Coraline Finbucks praised the model’s scalability. “SeaWorld is playing checkers in a kiddie pool. Ocean Zone is playing 5D chess in international waters,” she explained. “They’re already tracking laughs per gallon of seawater and smiles per nautical knot, and the numbers are explosive.”

Skeptics have raised concerns about ethics, legality, and “basic human decency,” but Ocean Zone remains unfazed. “Sure, its a nightmare for conservation. But it's a wet dream for profit maximization!" Cashwave exuded.

TL;DR — Remember, the oceans belong to investors. Not our children.

Self-proclaimed real estate mogul and motivational guru Grant Cardone has announced his latest claim: his $25,000 “10X Survival Mastery” course is a more essential human need than food or shelter.

“Food? Shelter? That’s broke thinking,” Cardone told a crowd of cheering followers at his Miami compound. “You can’t 10X a sandwich, but you can 10X your mindset. Try sleeping under a bridge with the right mindset. You’ll be fine.”

Venture capitalist Jaxson Goldclutch is already backing the initiative. “Housing and meals are a dead-end market,” he explained. “Education courses that teach you to ignore hunger pangs? That’s the future. We expect a 400% ROI in the first quarter just from desperate people skipping rent.”

Critics have called the idea “predatory” and “insane,” but Cardone remains bullish. “If you can’t afford my course, you definitely need it,” he said. “Besides, you can always sell your house or crack to pay for it.”

TL;DR — Investors expect Cardone’s course to outperform basic human necessities by convincing people they don’t need them.

Why learn about corporate life from someone who lived it, when you could learn from someone who played it on TV? That’s the premise behind “Boardroom Bootcamp,” a new seminar series hosted by Suits star Gavin Spectre (real name: Kyle Henderson), who has never worked a real corporate job but once filmed in a boardroom set for nine seasons.

“I know more about corporate mergers than most CEOs,” Henderson claimed. “Sure, it was scripted, but the lighting was great, and my tie was always perfect.”

Investors are already salivating. “This is genius,” said venture capitalist Sterling Cashmere. “Actual executives are boring. Henderson delivers the fantasy of business without the spreadsheet migraines. This could replace the entire MBA market.”

Critics have questioned the value of learning from an actor, but bullish backers insist that authenticity is overrated. “People who don’t know business really love learning from people who played business on TV,” explained Cashmere. “I think it’s because actual business classes are boring AF.”

TL;DR — Investors believe actors who play businesspeople on TV are the future of business education, because real business is way too boring.

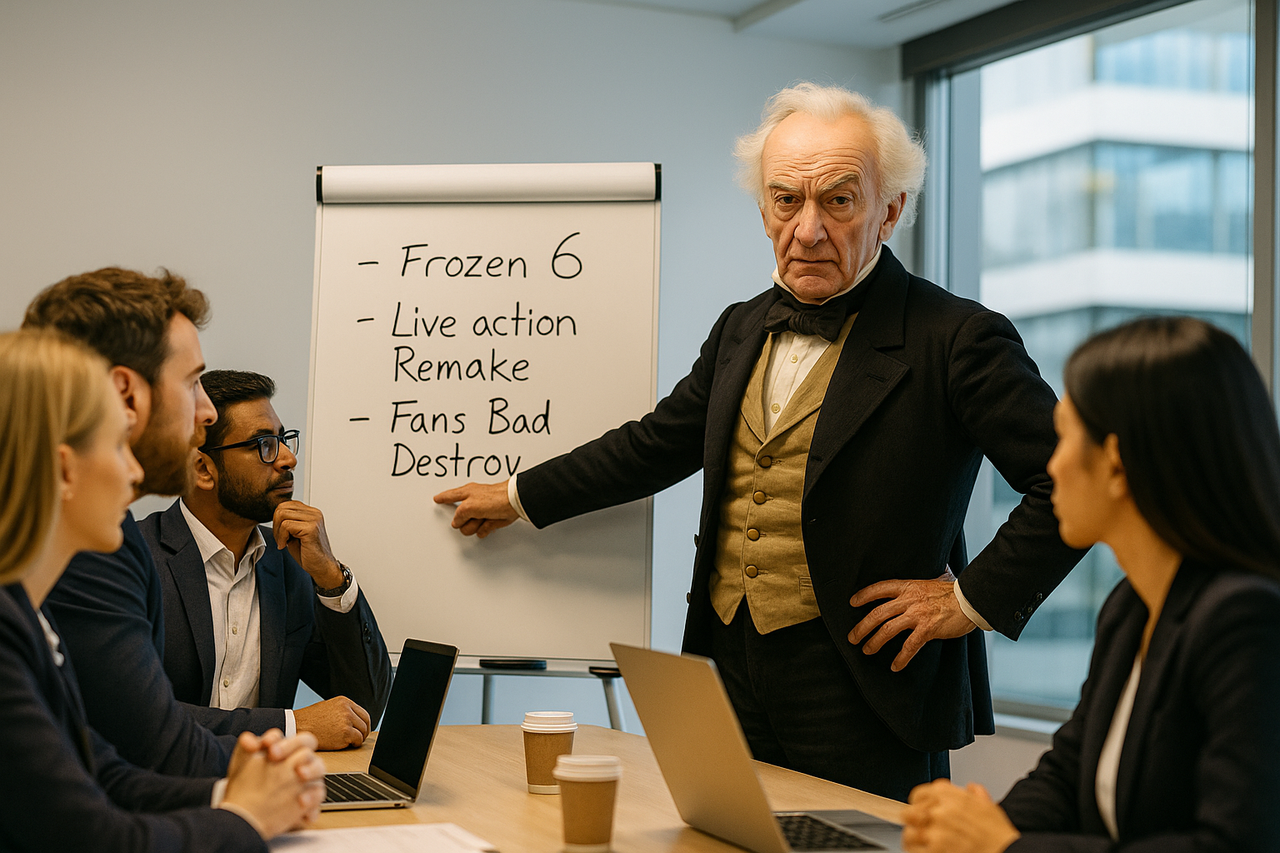

In a shocking-yet-entirely-on-brand leak, internal Disney documents have confirmed the existence of a dedicated Fan Agitation Department; a team tasked solely with enraging segments of their audience just enough to keep them doomscrolling.

“Our data shows that mild to moderate outrage keeps engagement 400% higher than joy,” explained Disney’s Head of Narrative Trolling, Gibson F. Clickbait. “If we can keep you mad, we can keep you watching.”

The department allegedly has entire sub-teams for each major fandom, with specialized “Bait Units” designing casting announcements, poster art, and out-of-context quotes guaranteed to ignite months of YouTube rant content.

“This isn’t just entertainment, it’s outrage-as-a-service,” said venture capitalist Madison Shilltop, who is “all in” on Disney’s strategy. “Look, joy burns out after the credits roll. But anger? That’s evergreen. This will 10X Disney’s market cap by 2027.”

Leaked slides show the department’s key metric is Audience Blood Pressure Per Minute of Screen Time with 2026 targets described as “ambitious but achievable.”

TL;DR: Disney has weaponized fan irritation into a growth strategy, and investors are euphoric about the endless supply of free publicity.

A newly funded startup, HypeCubed, claims it has cracked the formula for designing toys that sell out instantly — not because kids love them, but because opportunistic relatives do.

“Our crack team of designers can make the toy just the right amount of cute, creepy, and otherworldly,” said HypeCubed co-founder Rick Flipworth, speaking from a rented conference room decorated entirely in Funko Pops still in their original boxes. “It’s about hitting that sweet spot where parents think it’s adorable, but kids aren’t sure if it’s going to hug them or haunt them.”

The company’s proprietary “Artificial Hype Intelligence” allegedly predicts which designs will cause the most emotional distress when unavailable, then leaks just enough fake insider info to fuel panic buying.

“Look, nostalgia is the most powerful drug,” said venture capitalist Bentley Hoardsworth, who invested after his own nephew cried over a sold-out plush. “If we can make a six-year-old sob on Christmas morning, that’s a KPI win.”

According to leaked financial projections, HypeCubed expects to measure success in eBay markup percentage per tear shed.

TL;DR — Why sell a toy once when you can make your customers fight each other for it, then buy it from your uncle at 400% markup?

A controversial new startup, iMidasWell, claims it has exclusive access to “residual innovation energy” emanating from the remains of Apple co-founder Steve Jobs — and that a single touch could turn any investor into a billionaire.

“We’re not saying it’s magic,” clarified CEO Chadwick Goldfinder III, while wearing a black turtleneck and holding a suspiciously Apple-looking urn. “We’re saying it’s a once-in-a-lifetime networking opportunity… with the afterlife.”

Venture capitalist Porter Cashcastle is already in for $50 million. “Look, this is better than crypto, AI, and biotech combined. It’s not every day you can buy shares in literal divine capitalism,” he said, while elbowing other investors out of the way to get in line for a “wealth infusion session.”

Skeptics have called the practice “morbid” and “probably illegal,” but iMidasWell insists it’s all about “channeling entrepreneurial essence.” Early adopters claim touching the urn boosted their net worth by 3%, although analysts point out this may have coincided with payday.

TL;DR — Investors are betting big that Steve Jobs’ remains hold the key to infinite wealth. Whether it’s science, superstition, or just really expensive cosplay, they don’t care the line forms to the right.

Lifestyle experimenter Trevor Banksworth IV claims he’s unlocked “the holy trinity of billionaire essence” after a week-long immersion in the habits of the ultra-wealthy.

“I had McDonald’s breakfast every morning like Buffett, wore the same grey T-shirt every day like Zuck, and perfected the haunting, elongated cackle of Bezos,” Banksworth explained. “By day three, I could feel my portfolio spiritually compounding.”

Investors are already bullish. “If you can mimic even 12% of Bezos’s laugh, your valuation doubles overnight,” insisted hedge fund manager Sterling Coinhaven, who has since adopted a Buffett diet and reports a notable uptick in unsolicited startup pitches.

Skeptics point out that Banksworth’s net worth remains largely unchanged, but he insists the real value is “in the cosmic networking” achieved. “I didn’t just meet God,” he said, “I made Him my LinkedIn connection.”

TL;DR - The only pathway to wealth is to copy odd personality quirks. Stop trying to maximize your productivity or learn things.

Disruptive entrepreneur Blaine Jetstream shocked Silicon Valley last week after securing $12 million in seed funding moments after urinating on venture capitalist Clive Goldbreath during a pitch meeting.

“I thought it was a dominance display,” Goldbreath explained while wiping his Armani blazer with a silk napkin. “Frankly, I’ve never been more convinced in a founder’s conviction. The TAM for this level of audacity is limitless.”

Blaine’s startup, HydroAssert, claims it will “redefine human-liquid interaction spaces” by turning bodily functions into scalable SaaS platforms. Details remain vague, but investors insist that’s a feature, not a bug.

“You can’t teach this kind of vision,” said hedge fund opportunist Maxwell Coinshaft, visibly giddy. “If a founder is willing to cross that line in a pitch meeting, imagine the regulatory boundaries they’ll obliterate for profit.”

Skeptics question both the business model and Blaine’s understanding of assault law, but backers remain unfazed. “The next Uber will come from someone who’s unafraid to get a little… personal,” said Goldbreath. “Literally.”

TL;DR — Markets reward confidence, even when it’s streaming down your bespoke suit.

Serial idea haver Chadwick Moonforge claims he’s stumbled onto the ultimate startup concept: “We’re merging ridesharing, streaming content, e-commerce, and orbital payload delivery into one frictionless, subscription-based, blockchain-enabled ecosystem.”

Investors are calling it “the singularity of synergy.”

“We’ll have a marketplace where you can order a rocket ride to your coworking pod on Mars, stream The Office the entire way, and have artisanal dog treats waiting for you on arrival,” Moonforge explained. “Think Prime, but interplanetary. Think Uber, but zero gravity. Think Netflix, but you can’t log out because you’re in space.”

Funding interest is already exploding. Sterling Coinhaven, who dumped his entire renewable energy portfolio to get in early, said: “I don’t know what it is. I don’t think they know what it is. But I invest in founders, not reasonable business plans.”

Critics say it’s “four companies duct-taped together with buzzwords,” but Moonforge disagrees. “If I can confuse the market long enough to IPO, I win,” he said. “And I plan to confuse them from here to the asteroid belt.”

TL;DR — If your startup pitch sounds like a hallucination, you’re halfway to unicorn status.

When your startup’s runway is shrinking faster than your Series C hopes, some founders are skipping traditional fundraising altogether and pivoting to what they call the “O Method” ... Marrying Oprah Winfrey.

“It’s not about love, it’s about liquidity,” said founder Chadwick Goldhammer, who’s been seen “accidentally” jogging past Oprah’s Montecito estate every morning for the last six weeks. “If you think venture debt is attractive, wait until you’ve got Oprah equity.”

Investors are bullish on the approach. “Oprah is the ultimate blue-chip asset,” claimed VC partner Lexington Prizewater, sipping a $42 latte. “You can’t IPO her, but she pays dividends in influence.”

Critics argue the plan is “ethically dubious” and “borderline creepy,” but early data suggests it works. One anonymous founder, now living on a ranch in Maui, reported, “My burn rate went from $1.2 million a month to zero overnight. Also, my book club attendance is mandatory now.”

TL;DR – Don’t scale your business. Scale your personal net worth by marrying someone whose book club selections move markets.